26-10-2023

How large would the cost to society be if we do not intervene? There are a number of direct costs related to this but also a number of indirect costs.

After 3 years, mentally healthy individuals with debts that are difficult to reconcile are 3 times more likely to experience mental health issues compared to individuals without financial stress. An individual who already had mental health issues prior to experience financial stress caused by debts does not heal as well or as fast. Three years on, they are 4 times more likely to still experience mental health issues compared to people who are not significantly indebted. The mental issues we refer to are: depression, anxiety and addiction.

Source: Trimbos Instituut

Mental healthcare is expensive. In 2015 OESO estimated the costs related to mental health issues in the EU amount to 4.1% of GDP. For Belgium this is 5.1%.

Source: Planbureau

Statistics show that the impact of financial stress is far deeper than just the debts themselves. Financial stress is a strong contributing factor to the occurrence of depression, burn-out and suicide.

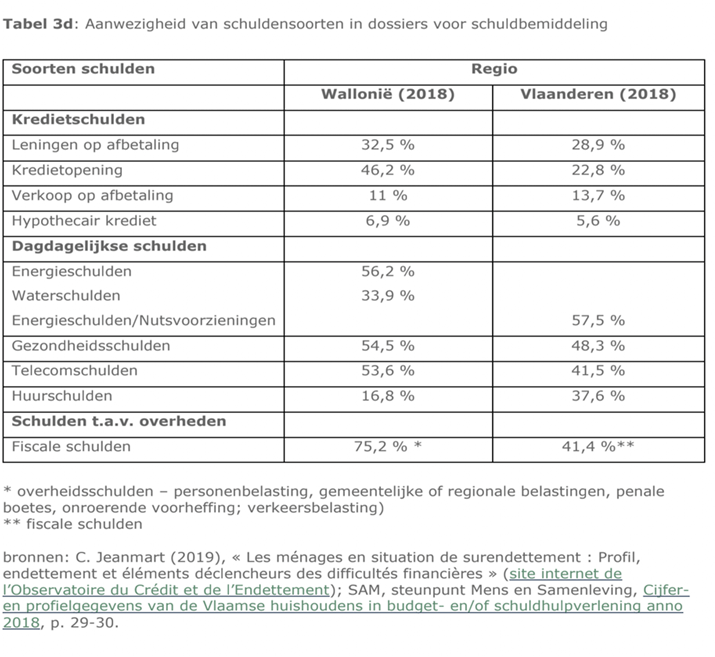

A great number of people are also dealing with debts owed to the government. This is yet another cost we have to carry as a society.

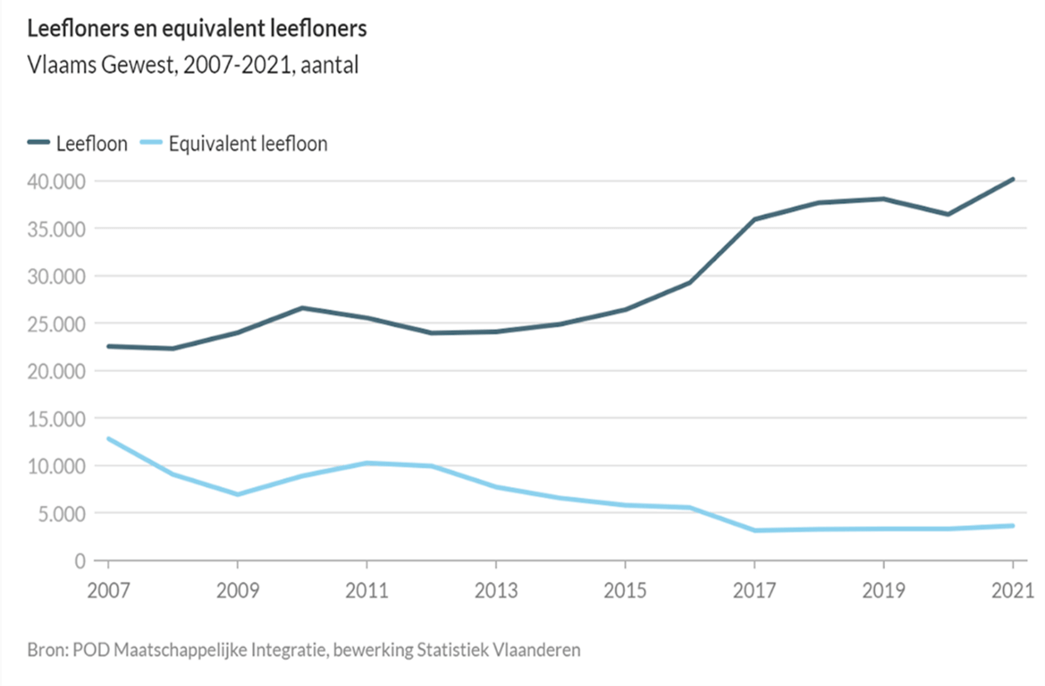

Another item that is noteworthy is that more and more people are making use of government welfare programs.

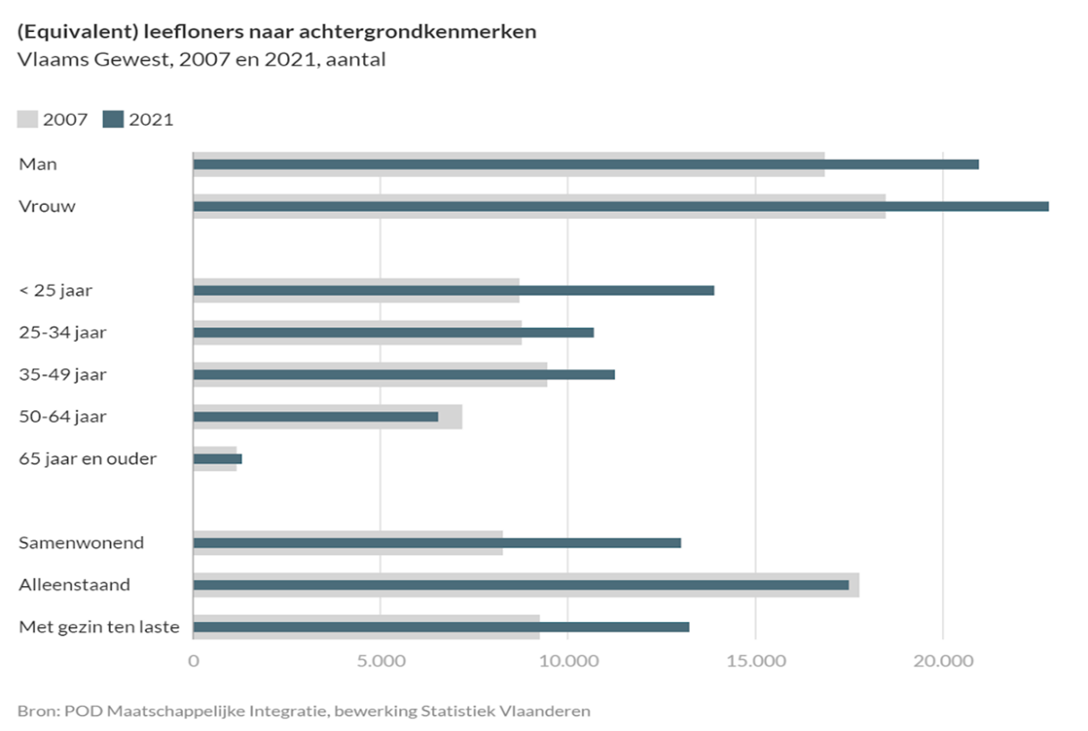

The under 25 age group is the fastest growing demographic for this type of program. Young adults are the future of our society and they, more than ever, are struggling.

We need to reverse this trend and our goal is to have an impact on this.