Increase your efficiency in administration and CRS

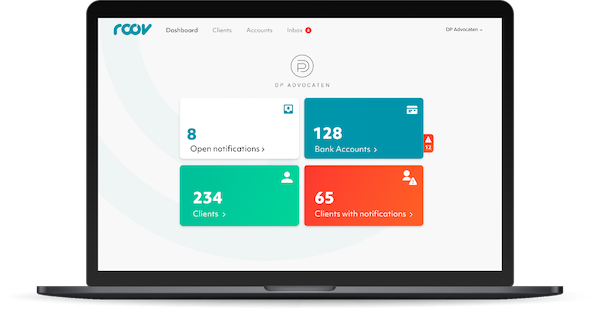

Every lawyer, debt mediator or budget manager can leverage ROOV’s advantages through better control of their day to day tasks. Activate bank accounts through the dashboard, connect your clients and work more efficiently than ever before. We can automate a large part of your work thanks to our PSD2 license. Get more control and automate to make your services more cost effective.

More profitable

Automate time intensive tasks like the daily monitoring of the accounts, checking the income and expenses of your client and yearly reporting. Become more efficient and work proactively to help your clients. Avoid extra costs associated with noticing client issues too late.

Less calls and emails

Transparency as part of the solution; a dashboard for you and an app for your clients. The app keeps your clients up to date about any transactions on your custodial account. No more communication needed to know if certain items have been paid or not but direct information that helps your client be involved.

More Control

Reaction time is very important when your client is experiencing issues, the sooner you are aware the better you can help and anticipate potential problems. Not only do you get insights into your own transactions but also into the transactions of your clients. Avoid bailiff visits when someone doesn’t manage to pay the rent or a bill.

Better support

People need the right tools to be more effective in their jobs. Thanks to our dashboard the day to day activities related to helping clients become easier and more efficient. The software is able to automate tasks that previously needed hands on attention.

Thanks to ROOV our entire office saves a lot of time. Time we invest back into providing a better service for our clients. Thanks to more control we are significantly more efficient.

Jürgen Van den Bossche

Lawyer

ROOV helps us streamline administrative processes, allowing us to focus more on our core competence: assisting our pupils from day to day.

Jo De Nul

Lawyer

What is a PSD2 banking license?

PSD2, also known as Payment Services Directive 2, is a European guideline relating to payments based services. The guideline obliges banks to share payments data and bank account information with recognised, trusted, third parties if the end user has instructed them to do so. The third party needs to have obtained a license from the National Bank of Belgium in order to be able to receive the data. As a user, you can only give this type of permission to an entity that has received a PSD2 license. A PSD2 license is only issued after significant and ongoing auditing of the companies’ compliance practices, IT, security and more. Because of this you can be sure that your data is safe due to the strict regulatory obligations placed on the company.

Privacy is one of our most important values. Your data is stored on Belgian servers that comply with the strictest security standards in the business. Because we work through a license of the National Bank of Belgium we also have to comply with strict rules and regulations related to data storage and security. We fully understand that the data we deal with is sensitive and, as a result we treat it with care and with fundamental respect for user privacy.

ROOV is easy to reach for any of your questions. Double check if your question has already been answered at our helpdesk; question not included? Send us an email at customercare@roov.app. If you’re a member of the press you can reach us at press@roov.app

Every customer is important to us: Debt mediator, guardian, social service providers, budget managers, … We have developed specific features for each of them. In order to give you the best possible overview of our services, we look forward to schedule a meeting with you where we can demo our tools. Send us your contact details and we will get in touch with you.

Our pricing is based on a number of variables like number of clients, type of client, app usage, etc. We look forward to explaining our pricing model in detail during a meeting with one of our team members. Send us your contact details and we will get in touch with you for a custom proposal.

What is the advantage for someone under debt mediation?

We built an app that fosters transparency and helps your clients be more involved with completing their debt mediation journey. Our main goal is to make sure that your end customer becomes better at managing finances and get them involved with debt mediation journey.

Didn’t find the answers you were looking for?